Digital payments are the backbone of India’s economy in 2025, with Unified Payments Interface (UPI) leading this cashless revolution. From street chaiwalas to high-end tech firms, everyone is tapping into UPI 2.0’s speed, security, and unprecedented reach. Let’s dive into what’s new, why it matters, and how it’s shaping daily life.

Introduction

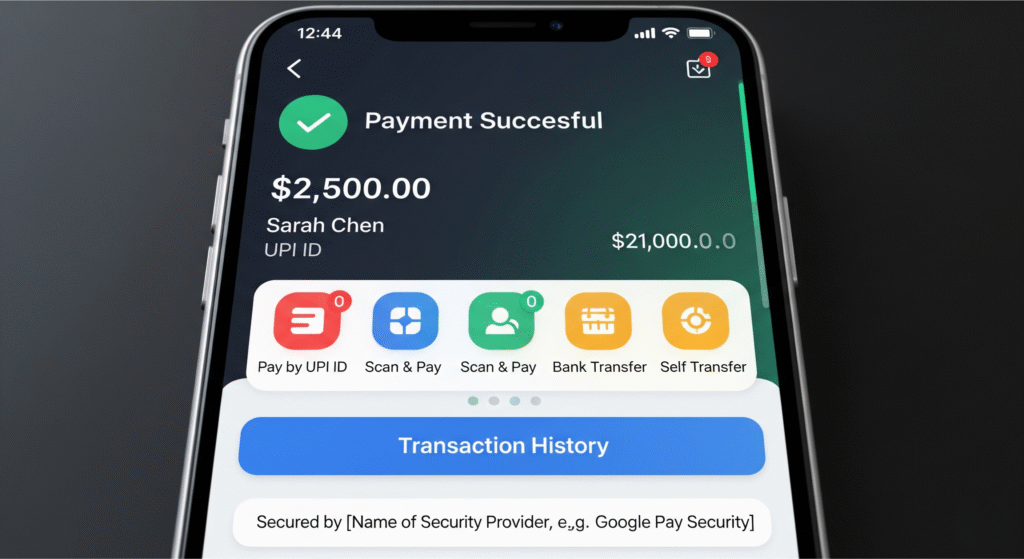

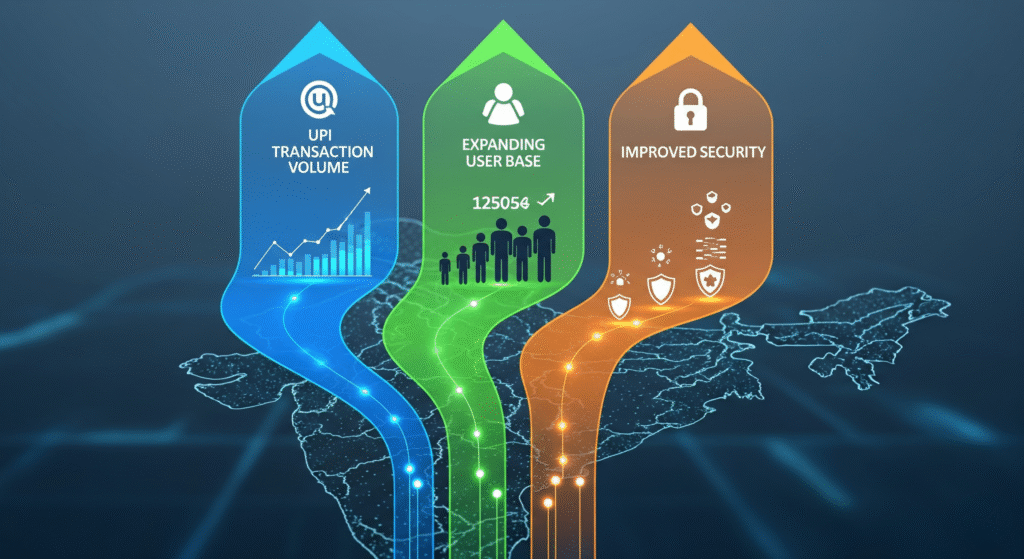

Physical cash is quickly disappearing from Indian wallets. UPI transactions now cross 20 billion per month, fueling everything from grocery shopping to gig work payouts. The latest updates bring smarter, safer, and even more inclusive digital payments for all Indians.

Recent News and Trends

- UPI 2.0 Expansion: In July 2025, NPCI launched cross-border UPI trials with Southeast Asia and Gulf countries, enabling Indians abroad to pay and remit seamlessly.

- Offline Payments: Even in rural areas with patchy internet, UPI “tap and pay” works offline thanks to QR-enabled smart cards.

- Security Overhaul: New AI-powered fraud detection reduces scam incidences by over 70%, building greater trust among elderly and first-time users.

- Integration with Credit: Now, users can make UPI payments directly from credit lines, increasing flexibility for youth and businesses.

How Digital Payments Are Changing Everyday Life

- Street Smarts: From local fruit vendors to autorickshaws in Jaipur, UPI empowers small businesses to accept digital money with zero setup costs.

- Youth Power: College students use UPI not just for food delivery and shopping, but also to split bills, buy event tickets, and receive gig economy payments.

- Seniors Go Digital: Easy-to-use voice-guided payment features are making grandmas and grandpas comfortable with tap-and-pay.

- Super Apps and Rewards: Apps like PhonePe, Google Pay, and Paytm now offer bill payments, insurance, travel bookings, and cashback all in one place.

The Opportunities

- Empowerment: Small shopkeepers, handicraft sellers, and gig workers now join the digital economy, increasing income and access to customers.

- Jobs: Rapid fintech growth opens career paths in cybersecurity, customer support, UX design, and payment product management.

- Financial Literacy: NPCI’s new “UPI Learning” initiative offers short explainer videos in Hinglish and regional tongues, making tech adoption simple for all.

Challenges and Concerns

- Cybersecurity: As payments soar, so does the risk—phishing, social engineering, and fake QR code scams require constant user awareness.

- Inclusion: Despite offline features, some remote regions still wait for reliable internet and outreach.

- Transaction Limits: High-value purchases often face transaction caps, sometimes making cash a fallback.

What Should Young Indians Do?

- Stay Secure: Enable app locks, avoid sharing OTPs, and report suspicious QR codes.

- Explore Fintech Careers: With the digital economy booming, roles in analytics, data science (your field!), and AI-driven fraud detection are hot.

- Spread the Word: Help less tech-savvy family and friends with simple digital payment how-tos.

Conclusion & Call-to-Action

India’s UPI 2.0 is powering dreams, boosting small businesses, and making life easy for everyone from students to grandparents. Are you making the most of this digital payment wave?

How has UPI changed your daily life? Have you faced any interesting digital payment stories? Share your experience below—and help others join the cashless movement!

“India’s payment revolution isn’t just about money—it’s about digital empowerment for every citizen.”

– Samast India Editorial