The Indian stock market is painting the town green this August, and young investors across the nation are celebrating their biggest wins yet. With Sensex crossing new records and small-cap stocks delivering explosive returns, this isn’t just a bull run—it’s a generational wealth-building moment. But what’s driving this surge, and how are young Indians making the most of it?

Introduction

From college dorms to corporate offices, conversations about stocks, mutual funds, and trading apps dominate lunch breaks and Instagram stories. August 2025 has witnessed unprecedented participation from investors under 30, transforming the way India thinks about money, investing, and financial independence.

The Numbers Behind the Hype

- Record-Breaking Surge: The Sensex has gained over 8% in August alone, while Nifty 50 touched new all-time highs daily. Mid-cap and small-cap indices are up 12% and 15% respectively this month.

- Youth Power: Over 3 crore new demat accounts were opened in 2025, with 65% belonging to investors aged 18-35. Trading apps report their highest-ever daily active users.

- SIP Revolution: Monthly SIP inflows have crossed ₹20,000 crore, driven primarily by young professionals investing ₹3,000-₹15,000 monthly.

- AI and Fintech Boom: Stocks related to artificial intelligence, fintech, and renewable energy are leading the charge, with some giving 300%+ returns this year.

What’s Driving This Bull Run?

- Global Tech Rally: International positive sentiment toward AI and tech stocks is benefiting Indian IT and startup companies.

- Government Policy Support: New policies favoring digital infrastructure, green energy, and startup funding have boosted investor confidence.

- Foreign Investment: FIIs (Foreign Institutional Investors) have pumped in ₹45,000+ crore in August, showing global confidence in India’s growth story.

- Economic Indicators: Strong GDP growth, declining inflation, and robust corporate earnings have created the perfect storm for market euphoria.

How Young Investors Are Playing the Game

- App-First Approach: Platforms like Zerodha, Groww, and Angel One have made investing as easy as ordering food, with gamified interfaces and educational content.

- Community Learning: WhatsApp groups, Discord servers, and YouTube channels dedicated to stock tips and analysis have millions of young followers.

- Diversification Strategy: Unlike previous generations, young investors are spreading money across equity, mutual funds, crypto, and even international markets.

- Long-term Vision: Most are investing for goals like buying homes, starting businesses, or achieving financial independence by 35.

Success Stories That Inspire

- Small-Town Heroes: Students from tier-2 cities are turning ₹10,000 investments into lakhs through systematic investing and learning.

- Side Hustle Investors: Working professionals are using trading profits to fund their startups, travel dreams, and higher education.

- Family Financial Advisors: Many young investors are now teaching their parents about mutual funds, SIPs, and digital investing.

Risks and Reality Checks

- Market Volatility: What goes up can come down—August’s gains could face corrections, and young investors need to prepare mentally and financially.

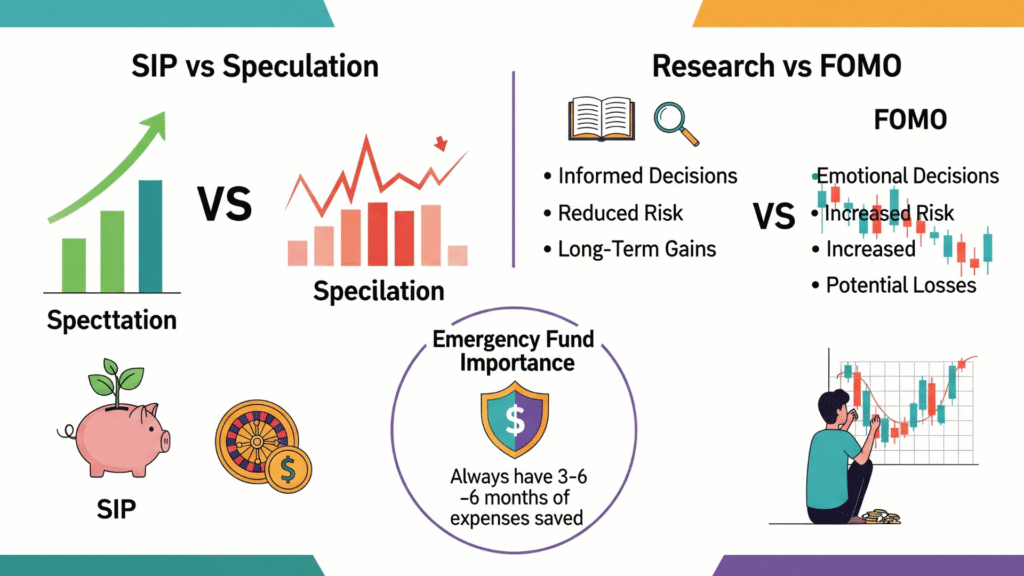

- FOMO Investing: Social media hype around “hot stocks” is leading some to make emotional rather than research-based decisions.

- Leverage Risks: Easy access to margin trading and futures has some young investors taking dangerous bets beyond their risk capacity.

- Lack of Emergency Funds: Many are investing without building sufficient emergency savings first.

Skills That Separate Winners from Losers

- Financial Literacy: Understanding P/E ratios, balance sheets, and market fundamentals rather than just following tips.

- Emotional Control: Staying calm during market volatility and sticking to long-term goals.

- Continuous Learning: Following credible financial news, learning from mistakes, and adapting strategies.

- Risk Management: Never investing more than you can afford to lose, diversifying across asset classes.

Government and Regulatory Support

- Investor Protection: SEBI’s new rules protect small investors from misleading tips and ensure better transparency.

- Financial Education: Government initiatives are promoting financial literacy through schools and digital platforms.

- Tax Benefits: ELSS mutual funds and long-term capital gains treatment encourage systematic investing.

What Young Indians Should Do Right Now

- Start Small: Begin with ₹1,000 monthly SIPs rather than trying to time the market with large investments.

- Educate Yourself: Use free resources, follow credible financial advisors, and understand what you’re investing in.

- Build Emergency Fund: Invest only after securing 6 months of expenses in liquid savings.

- Think Long-term: The stock market rewards patience—focus on 5-10 year goals rather than quick profits.

Conclusion & Call-to-Action

India’s August 2025 bull run isn’t just about making money—it’s about a generation taking control of their financial future. While markets will have ups and downs, the investing habit you build today will compound into wealth tomorrow.

Are you riding this bull run or still thinking about starting? What’s your biggest investing win or lesson learned? Share your investment journey below—let’s learn from each other’s experiences!

“The best time to start investing was yesterday. The second-best time is today.”

– Samast India Editorial