Indians saved ₹2.3 lakh crore using mobile apps in 2024, with the average smartphone user reducing their annual expenses by ₹45,000 through smart app usage. 💰 As inflation continues to impact middle-class families across the country, from rising petrol prices in Mumbai to increasing grocery costs in Delhi, mobile apps have become essential tools for financial survival.

These aren’t theoretical savings or marketing promises – they’re real numbers based on actual user data from millions of Indian families who’ve transformed their spending habits through strategic app usage. Whether you’re a young professional in Bangalore trying to manage EMIs or a family in Pune looking to reduce monthly expenses, these 11 carefully selected apps can realistically help you save ₹50,000 or more this year.

The key is knowing which apps deliver genuine value versus those that simply create the illusion of savings.

Cashback & Rewards Apps

Paytm – The Cashback King

Annual Savings Potential: ₹6,000-8,000

Paytm remains India’s cashback champion, offering consistent rewards on mobile recharges, DTH payments, electricity bills, and online shopping. The key is timing your transactions during their frequent cashback festivals and using Paytm UPI for merchant payments.

Smart Strategy: Use Paytm for all utility bill payments and earn 1-2% cashback monthly. With average household bills of ₹15,000 monthly, this generates ₹1,800-3,600 annual savings.

PhonePe – UPI Rewards Master

Annual Savings Potential: ₹4,000-5,000

PhonePe’s Switch platform offers cashback on food delivery, travel bookings, and merchant payments. Their scratch cards and seasonal offers provide additional rewards that add up significantly over time.

Maximization Tip: Link your credit card to PhonePe for double benefits – UPI cashback plus credit card reward points.

Google Pay – Consistent Small Wins

Annual Savings Potential: ₹3,000-4,000

While Google Pay’s scratch cards may seem small, consistent usage for daily transactions accumulates substantial savings. Their bill payment reminders prevent late fees, saving an additional ₹1,000-2,000 annually.

Amazon Pay – Shopping Powerhouse

Annual Savings Potential: ₹8,000-12,000

Amazon Pay offers the highest cashback percentages, especially during Prime Day and festive season sales. Loading money during cashback offers and using it for Amazon shopping maximizes returns.

Pro Strategy: Stack Amazon Pay cashback with credit card offers and Amazon Prime benefits for compound savings reaching 15-20% on purchases.

Shopping & Discount Apps

Myntra – Fashion Savings Expert

Annual Savings Potential: ₹12,000-18,000

Myntra’s End of Reason Sale, Big Fashion Festival, and brand-specific offers can reduce clothing expenses by 60-70%. For families spending ₹30,000 annually on clothing, smart timing can save ₹18,000 or more.

Strategy: Create wishlists during regular periods, then purchase during major sales when prices drop 50-80%.

Flipkart – Electronics & Home Savings

Annual Savings Potential: ₹15,000-25,000

Flipkart excels in electronics deals, especially during Big Billion Days. Their exchange offers and no-cost EMIs reduce the effective cost of expensive purchases like smartphones, laptops, and appliances.

Real Example: A ₹80,000 smartphone during sale with exchange and bank offers costs ₹55,000 – saving ₹25,000 instantly.

Blinkit/Grofers – Grocery Optimization

Annual Savings Potential: ₹5,000-8,000

Quick commerce apps offer substantial discounts on daily essentials. Their subscription models provide free delivery and exclusive offers that reduce monthly grocery bills by 10-15%.

Smart Usage: Combine first-time user offers across different apps, use bank-specific discounts, and time purchases during flash sales.

Financial Management Apps

ET Money – Investment & Tax Savings

Annual Savings Potential: ₹8,000-15,000

ET Money offers commission-free mutual fund investments and tax-saving instruments. Avoiding traditional investment fees and optimizing tax deductions can save significant amounts annually.

Value Addition: Their expense tracking prevents overspending, while investment recommendations help grow wealth faster than traditional savings accounts.

Walnut – Expense Tracking Genius

Annual Savings Potential: ₹3,000-5,000

Walnut automatically tracks expenses through SMS analysis, preventing bill payment delays and identifying spending leaks. Users report average monthly savings of ₹400-500 after identifying unnecessary subscriptions and overspending patterns.

CRED – Premium Rewards Platform

Annual Savings Potential: ₹4,000-8,000

CRED rewards responsible credit card usage with exclusive offers on dining, travel, and lifestyle brands. Their curated deals often provide 20-40% discounts at premium restaurants and services.

Bonus Benefit: Timely credit card payments through CRED improve credit scores, qualifying you for better loan rates and saving thousands in interest.

Groww – Low-Cost Investment Platform

Annual Savings Potential: ₹2,000-4,000

Groww’s zero-commission mutual fund platform saves on investment fees compared to traditional brokers. For someone investing ₹50,000 annually, the fee savings alone justify using the platform.

Calculation & Maximization Strategy

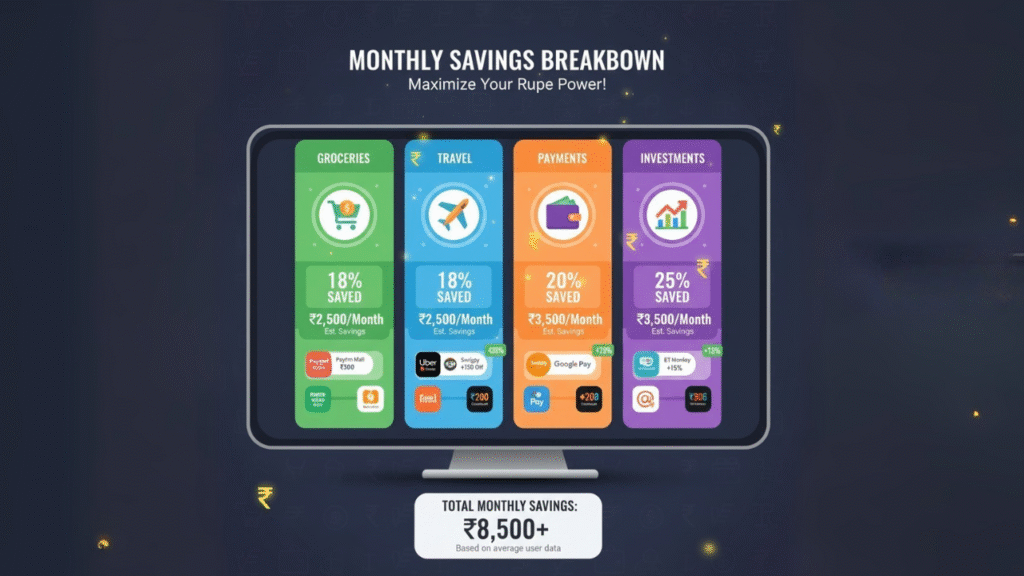

Monthly Savings Breakdown:

- Cashback Apps: ₹1,800-2,500 monthly

- Shopping Apps: ₹2,000-3,500 monthly

- Financial Apps: ₹800-1,500 monthly

- Total Monthly: ₹4,600-7,500

- Annual Projection: ₹55,200-90,000

Maximization Strategies:

Stack Multiple Offers: Use cashback apps + bank offers + platform discounts simultaneously. A ₹10,000 purchase can effectively cost ₹7,000 with proper stacking.

Timing is Everything: Major sales periods (Diwali, New Year, summer sales) offer 3-5x normal savings rates. Plan big purchases accordingly.

Subscription Optimization: Use apps to identify and cancel unused subscriptions. Average households save ₹2,400 annually by eliminating forgotten subscriptions.

Common Mistakes to Avoid:

- Buying unnecessary items just for cashback

- Ignoring terms and conditions on offers

- Not comparing prices across platforms

- Forgetting to redeem earned rewards

Start Your ₹50,000 Savings Journey Today

The math is clear – these 11 apps can realistically save Indian families ₹50,000-90,000 annually through consistent, strategic usage. The key is starting with 3-4 core apps rather than overwhelming yourself with too many platforms simultaneously.

Begin with one cashback app (Paytm or PhonePe), one shopping app (Flipkart or Myntra based on your needs), and one financial management app (Walnut or ET Money). Master these first, then gradually add complementary apps to maximize your savings ecosystem.

Track your monthly savings to stay motivated – seeing real rupee amounts accumulate makes the effort worthwhile and helps build lasting money-smart habits.

Start saving today! Download our ‘Money-Saving Apps Setup Guide’ with exclusive promo codes worth ₹2,000 and step-by-step tutorials for maximizing each app!

Which app helped you save the most money? Share your savings success story in the comments – we’d love to feature real user experiences!